Guidance Notes

Latest Guidance Notes

Guidance for Employers on the Appropriate Use of the U32006A Form for Suspension without Pay

Dear Members, We are sharing some guidance with you on how employers should appropriately use the NIS "U32006" form commonly termed as the Green Paper when handling Suspension without Pay.Please select here or the button shown below to load and save the guidance for ease of reference. BEC-Guidance-Appropriate-Use-of-NIS-U32006A-Form-for-Suspension-without-Pay-1Download Should you require any further clarification on

Guidance for Employers on Leave Arising from COVID-19 Exposure

This guidance is not intended to be a policy document but to provide general guidance for managing leave due to COVID-19 exposure. Employers are advised to continue to be guided by the Ministry of Health and Wellness and Public Health Officials in the development of their protocols. Please contact the BEC for further guidance on

BEC Guidance – Amendments to Severance Payments CAP.355A

There were amendments made to the Severance Payments Act as a result of the public health emergency declared on March 28, 2020. The changes are temporary and effective June 01, 2020 to July 31, 2020.

Bill to amend the Severance Payments Act, Cap. 355A.

An Act to amend the Severance Payments Act, Cap. 355A.

Managing The COVID-19 Pandemic In The Workplace

Although the COVID-19 originated in China, over 100 countries have now reported laboratory-confirmed cases of COVID-19 leading WHO to declare a global pandemic. Given that employers have an obligation to ensure a safe workplace, which includes taking steps to guard against the risk of infectious diseases, the outbreak of this new virus should prompt employers

EMERGENCY MANAGEMENT (COVID 19) ORDER, 2020

The Cabinet, in exercise of the powers conferred on it by section 28A(4) and (5) of the Emergency Management Act, makes the following Order, click Here to download

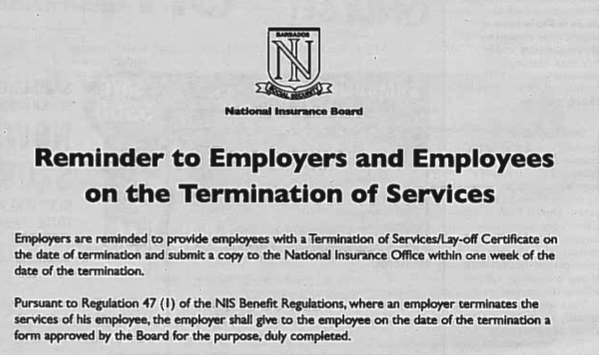

NIS Reminder to Employers and Employees – Termination of Services

This is a notification which serves as a reminder from the National Insurance for all employers.

The Police Certificate of Character Online Service

Dear Members, The process for applying for the Police Certificate has changed effective from 2nd March 2020. Users can now apply, pay and receive their certificates in one smooth operation. Please see attached information relating to the new modern system. The Ministry of Innovation Science and Smart Technology in association with the Royal Barbados Police

BEC Guidance – Barbados Revenue Authority – Personal Income Tax (PIT)

The Minister of Finance and Economic Affairs during the Budgetary Proposal and Financial Statement of March 20, 2019, stated: “...Effective July 1, 2019, the first tax band will be $50,000 at a rate of 12.5% ... the second tax band is on taxable income over $50,000 which is charged a rate of 33.5%...” “...As of

Search Guidance Notes

Notes Archive

- October 2025

- August 2025

- July 2025

- April 2025

- January 2025

- July 2024

- June 2024

- February 2024

- July 2023

- May 2023

- April 2023

- February 2023

- January 2023

- November 2022

- October 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- July 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- March 2019

- March 2016