Help & FAQs

Below are some questions frequently asked and their responses. Should you require more information or if you do not see a question you may have for us, contact us today Email: [email protected] or [email protected], Tel: +1(246) 435-4753.

Below are some questions frequently asked and their responses. Should you require more information or if you do not see a question you may have for us, contact us today Email: [email protected] or [email protected], Tel: +1(246) 435-4753.

Employee Leave and Public Holidays

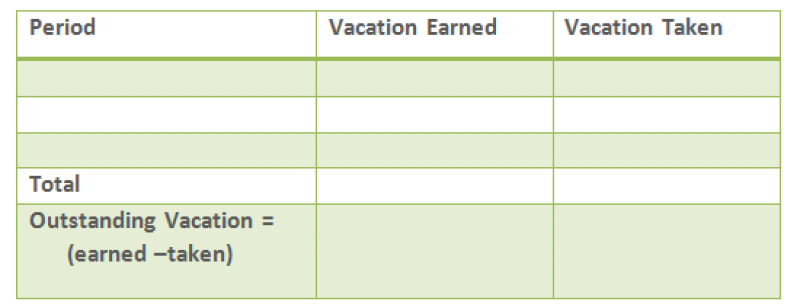

The easiest way to calculate the holiday payment entitled to a worker who has resigned is to create a reconciliation table. This table will utilise the anniversary date of the employee and take the form of the example below:

After reconciling how much holiday, if any, the individual has outstanding, you should use your normal method to calculate the monetary amount now due.

Weekly and monthly paid workers would normally receive payment for public holidays within their regular wages. There is no legal requirement to pay persons, who are remunerated based on time worked, for public holidays. Of note is that many Collective Agreements include clauses that state once an employee works the day before and the day after the holiday, they should paid for the public holiday.

When a public holiday falls within an employee’s vacation, the person’s vacation should be increased by the day. In the spirit of the Holiday with Pay Act, the public holiday should not be computed as a part of the employee’s annual holiday and the employee should be paid his average pay in respect of that day. An easy way to do this is using a calendar, count the vacation days that the employee is proceeding on vacation while omitting the public holidays.

There is no statutory entitlement to uncertified sick days within Barbados. However, most employers, recognising that there may be occasions when an employee is unable to report for duty due to illness, will grant a number of days leave with pay. In the absence of a collective agreement, the amount is at the discretion of management and should be clearly communicated to employees.

Employers in receipt of a certificate of illness from a doctor should ensure that the following information is clearly stated on the certificate:

- Name of employee

- Name and Signature of Doctor

- Date of return to work/period of leave

- Date of doctor visit

When an employee is away from work for an extended period of time on certified sick leave, one option for the employer is to request the employee to visit the company’s doctor, in order to determine if they are able to perform their duties as expected of them. The doctor should be provided with the employee’s complete job description, to adequately make that determination. Once fitness has been proven/disproven, then the company is better able to action the matter.

Employers are required under law to grant employees time off, with pay, when empanelled to perform Jury Duty. Employees are required to report for work, when not empanelled. Employers can verify when an employee was empanelled with the Registrar of Courts.

General

Lay-off is defined as a temporary stoppage of work where the employee is expected to be recalled. Short Time occurs when an employee is working for less than half of his/her normal earnings.

The Shops Act, CAP356A stipulates that shop assistants be allowed a rest period of at least 2 days per week. There is no specification that these days must be consecutive and therefore employers may schedule off days to suit the needs of the business.

The Shops Act, CAP356A states that “No shop assistant shall be required to work on the day a shop assistant observes as the day of religious worship.”

A domestic worker is defined as any person employed for reward for the purpose of performing household duties in a private dwelling house.

There is no compulsory age of retirement in Barbados. Companies that have pension plans should allow employees to retire when they have reached the pensionable age in compliance with their pension rules. In the absence of a pension plan, persons have used the age at which an individual can receive full NIS pension as their retirement age. The NIS Pensionable Ages are:

- Prior to January 2006 – 65 years

- January 01, 2006 to December 31, 2009 – 65 ½ years

- January 01, 2010 to December 31, 2013 – 66 years

- January 01, 2014 to December 31, 2017 – 66 ½ years

- January 01, 2018 and after – 67 years

NIS allows persons to apply for and receive pension from age 60. Early pension is granted at a reduced rate.

Health & Safety

The Safety and Health at Work (SHaW) Act 2005 is the most modern and relevant piece of legislation on Health and Safety in Barbados. It is set to be proclaimed on January 1, 2013 and should be utilised as a statutory guide. Another piece of Health and Safety legislation is the Accidents and Occupational Disease Notification Act which serves the specific purpose of requiring the reporting of accidents and diseases in the workplace.

A joint safety committee is a group, comprised of an equal number of management and employee representatives, which is responsible for administering and coordinating safety and health efforts within an organisation. The Safety and Health at Work Act (SHaW) 2005 requires that these committees be established in workplaces with 25 or more employees.

Senior management may select the management team representatives, however, the employees and their representative (if your business is unionised) must select their own safety committee representatives.

Employers are required to report workplace accidents to both the Chief Labour Officer and the National Insurance Department. To do this, it is essential that accidents are reported to supervisory personnel and appropriate records kept.

As soon as possible after the accident, complete the Occupational Accidents Form and submit to the Labour Department. On receipt of an employee’s claim for injury benefit, the NIS Department will send an Accident/Injury Form to the Company for completion. The NIS Form should be completed with all relevant details and promptly returned to NIS.

Failure to follow established Safety & Health rules should be treated as a disciplinary matter and subject to the standard disciplinary process that exists within your organisation.

Labour Legislation

There is no statutory requirement for the above query, as it is not included in the current legislation of Barbados. The grant of lieu days is a matter of custom and practice, especially for those organizations with salaried employees for which there is no statutory obligation for overtime payment. Management may use its discretion to develop and implement a policy which should be communicated to all employees and applied consistently.

The Employment Rights Act (ERA) was passed in both houses of parliament and was subsequently proclaimed by the Governor General on the 18th May 2012. The Act became law at the time of proclamation.

The BEC has developed a template available for purchase. Employers can reach out to us for such ensure they fulfil their statutory obligations.

The NIS Termination of Services/Lay-off Certificate should be prepared when an employee is terminated (dismissal with cause, redundancy, resignation) or is laid off. Additionally, when employees are placed on short-time they should receive a completed certificate. The completed form should be given to the employee and a copy submitted to the NIS within one week of the employee leaving service.

Termination of Services

Termination of employment can take several forms including:

- Dismissal with cause

- Redundancy

- Retirement

- Resignation

You should ensure that employees are paid the following upon termination:

- Payment up to and including the last day of work

- Any holiday that has accumulated but was not taken

- Notice pay as per contract of employment, if applicable

- Severance pay, if applicable

Any entitlement to a severance payment is based on an employee satisfying four conditions:

- The employee must be working for at least 104 continuous weeks;

- The employee must be dismissed for redundancy;

- The employee must be contracted to work for no less than 21 hours per week;

- The employee should be over 16 and under the pensionable age at the date of dismissal.

The Severance Payments Act Cap 355A states that payments shall be made within 2 months of becoming due.

Severance Payment and Notice Pay are not subject to NIS nor PAYE deductions. NIS and PAYE should be deducted from Holiday Pay. However, NIS contributions for Holiday Pay should be paid in one period and not spread over the length of the holiday. Regular deductions of PAYE and NIS are applicable to payment up to the last day of work.